Mileage Reimbursement 2025. The ato has announced the latest cents per km rate for business driving: Fy 2025 private reimbursement mileage rates.

Current mileage rate (2024) the irs standard mileage rates for 2024 stand at: The tier 1 rates reflect an overall.

India has its own set of travel reimbursement rules that you should understand, as it will affect how items are.

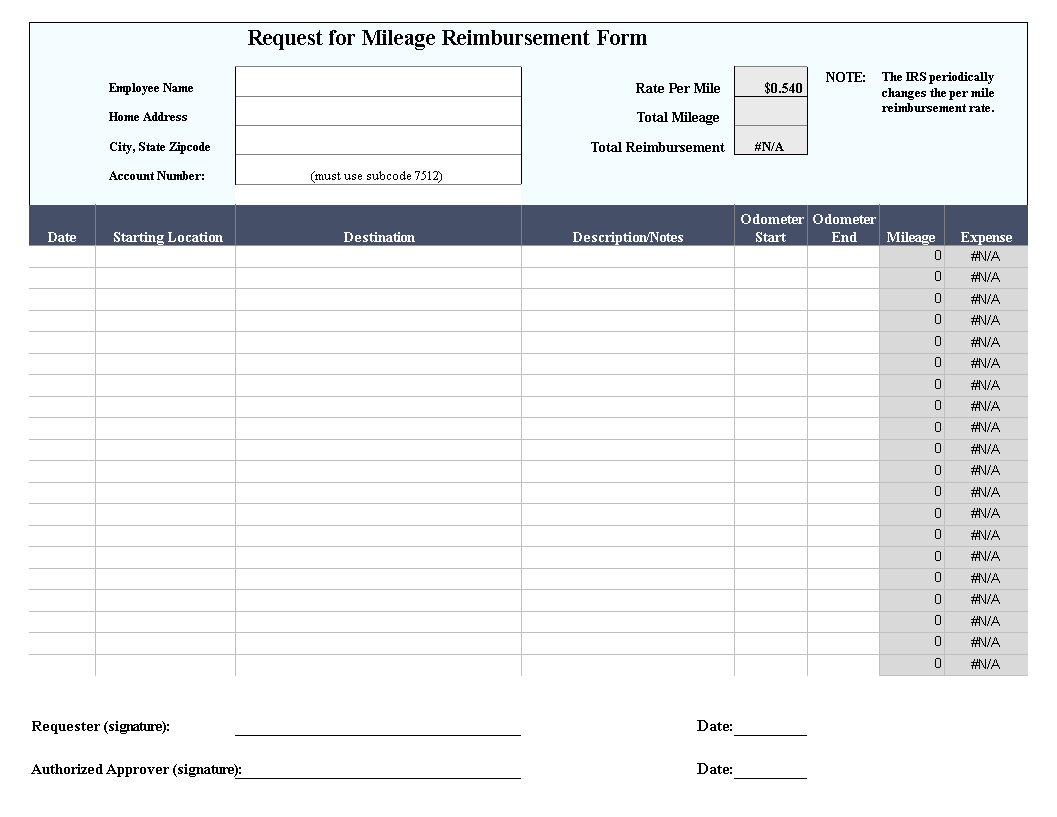

Free Mileage Reimbursement Form Template PRINTABLE TEMPLATES, For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. The internal revenue service (irs) has announced the standard mileage rates effective january 1, 2024.

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, Understanding the irs mileage reimbursement rules is crucial for employers, especially in states like california, massachusetts, and illinois, where reimbursement is. India has its own set of travel reimbursement rules that you should understand, as it will affect how items are.

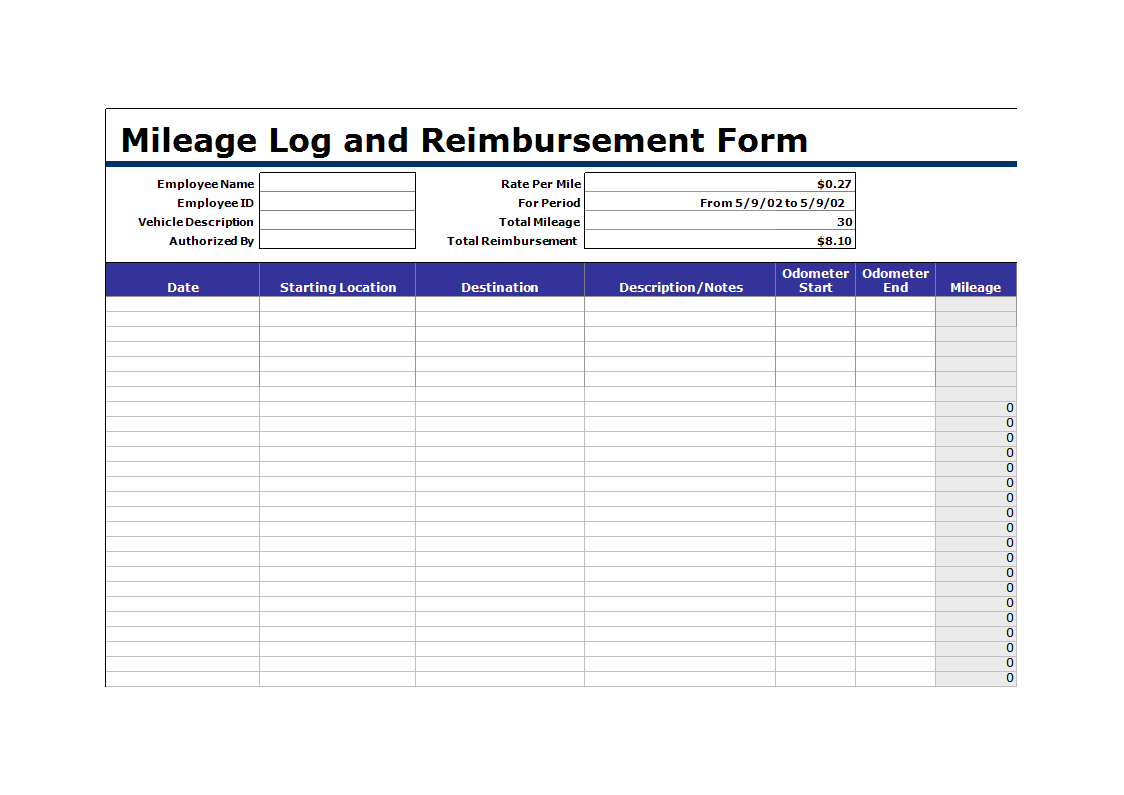

Mileage Reimbursement Form download free documents for PDF, Word and, When reimbursing an employee for work related travel while using their private vehicle, can i split the award travel reimbursement rate of $0.95c into $0.85c non. The tier 1 rates reflect an overall.

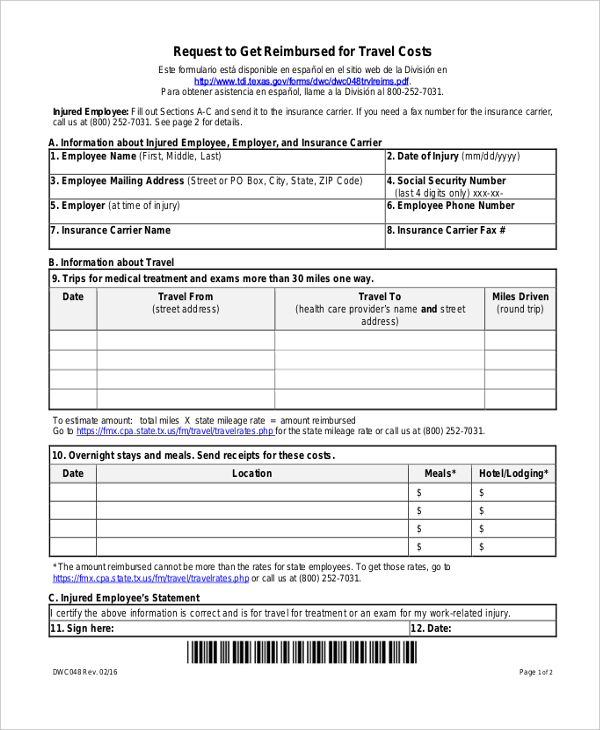

What is a Mileage Reimbursement Form EXPLAINED YouTube, Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes. Fsafeds participants can be reimbursed for mileage and parking expenses for travel to and from your doctor, dentist, pharmacy or other medical care provider.

Kostenloses Mileage Reimbursement Form, When you use your personal vehicle for business purposes, many employers will reimburse you per mile with mileage allowance payments (map). When reimbursing an employee for work related travel while using their private vehicle, can i split the award travel reimbursement rate of $0.95c into $0.85c non.

Kostenloses Mileage Log and Reimbursement Form sample, You can calculate mileage reimbursement in three simple steps: Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes.

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel, Input the number of miles driven for business, charitable, medical, and/or moving purposes. A guide to travel and mileage reimbursement in india.

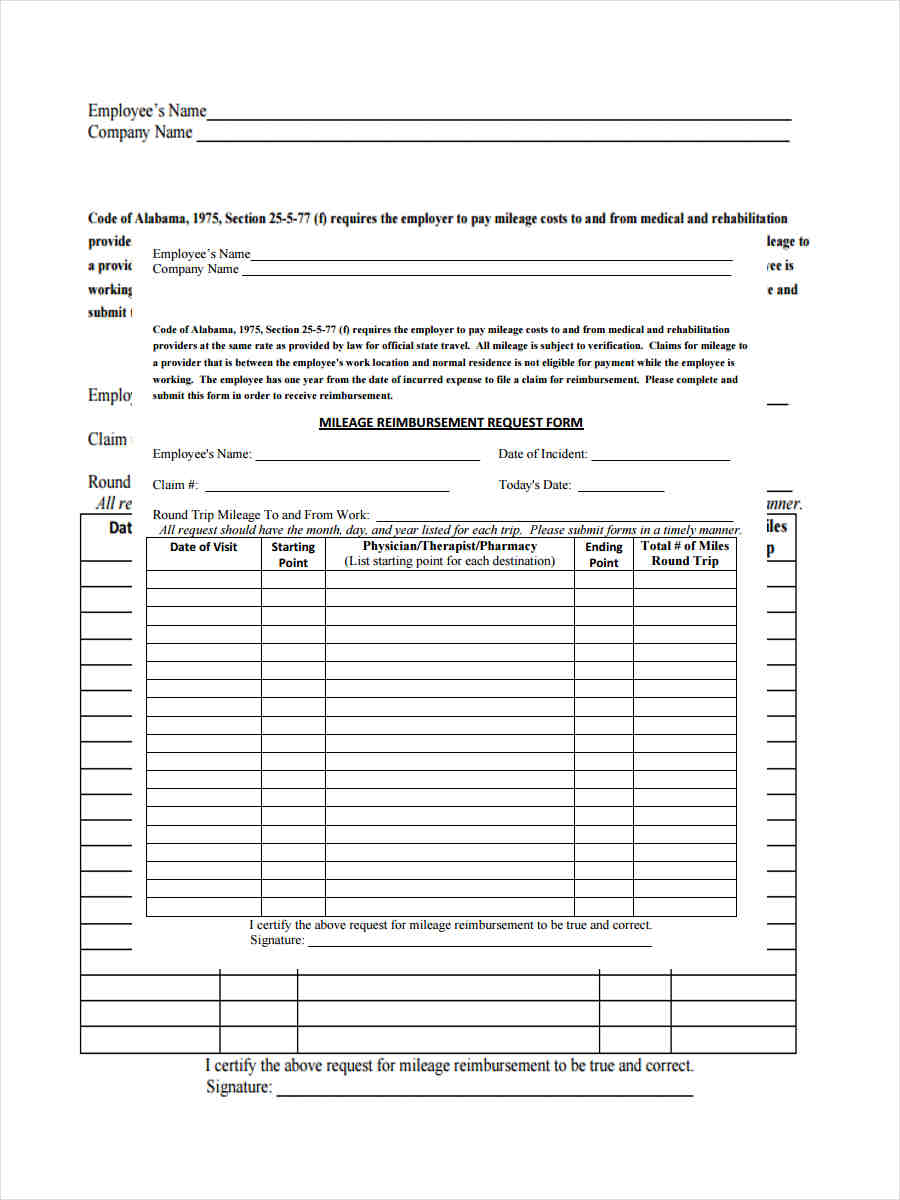

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, The ato has announced the latest cents per km rate for business driving: The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred. Travel — mileage and fuel rates and allowances.

Complete Guide on Mileage Reimbursement Policy ITILITE, The ato has announced the latest cents per km rate for business driving: Current mileage rate (2024) the irs standard mileage rates for 2024 stand at:

If your employer does not reimburse you, you can claim a mileage allowance from hmrc, known as mileage allowance relief, provided you meet the requirements.

Understanding the irs mileage reimbursement rules is crucial for employers, especially in states like california, massachusetts, and illinois, where reimbursement is.